Exciting news! House of Representatives passes bill requiring electronic filing of nonprofit tax returns

Our mission of increasing the availability of data about, and for, the nonprofit sector may seem ambitious—but it’s actually quite easy to identify some key datasets that can be leveraged by the sector to increase its impact and efficiency.

The T3010 tax filing dataset, the primary dataset containing comprehensive financial and activity information on Canadian charities, is a key example. This data has been publicly available by paper or datatape since 1975—and has been transcribed and made available online or by CD-ROM on request since 2000. In 2013 this data was finally released publicly by the CRA under an open data license. T3010 records have acted as a valuable source of information about the sector for government, academic researchers, and charities themselves. The open release of this data has put Canada on the map as a global leader in the effort to build a more transparent and information-driven nonprofit sector.

The United States is catching up. A parallel effort is being led by the Aspen Institute and their Nonprofit Data Project regarding Form 990 non-profit tax returns—which for a long time, were only available for purchase from the IRS as non-searchable images. In 2016, electronically filled Form 990s were released openly as machine-readable, searchable data by the IRS. However, a significant portion—about 40%—of 990 forms are still currently filed by paper, and at this time, data from these are not openly available.

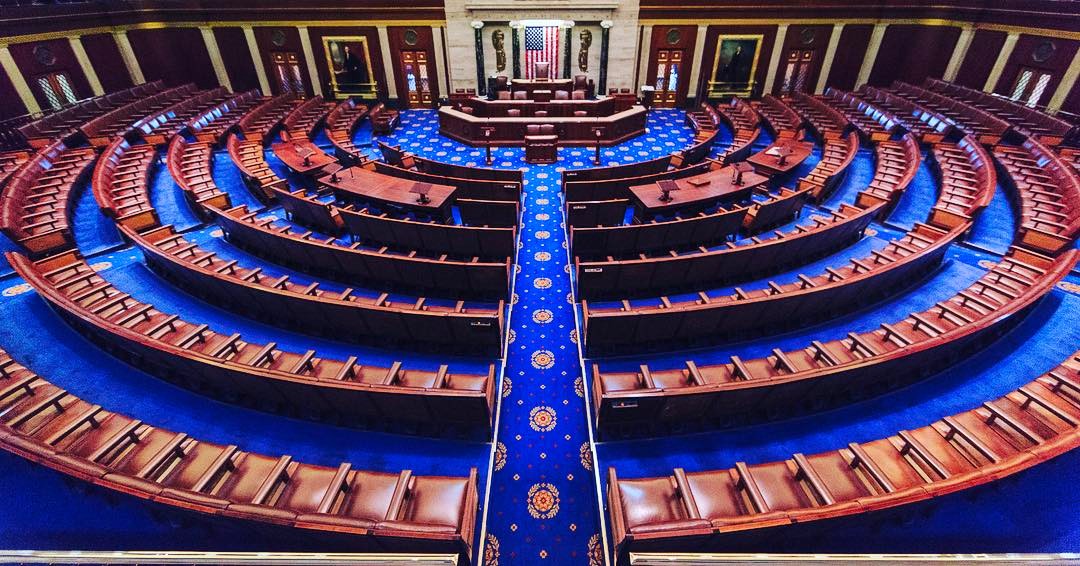

As such, we were excited to hear that earlier this week, the United States House of Representatives passed a bill requiring the electronic filing of Form 990 tax returns. This bill would also require data from these forms to be released openly in a machine-readable format. The bill now moves to the U.S. Senate.

This would be a huge step forward in nonprofit transparency for the United States. We want to congratulate Cinthia Schuman Ottinger and the Aspen Institute’s Nonprofit Data Project for their work in continuing to push for this reform. We’re cheering you on from up north!

P.S. We're looking into the practice of collecting and sharing of charity tax or registration data in other countries with our colleague Elizabeth Bloodgood. Be sure to join our mailing list if you’d like updates!